“Suggestions would be to discuss with contractors you worked with, see if you can find your contracts, ask neighbors for affidavits, check for permits you filed with the town for improvements, look for any paperwork you saved on the purchases, look for old bank statements and credit card statements.”

How do you prove home improvement to the IRS?

Proving Your Property's Tax Basis to the IRS

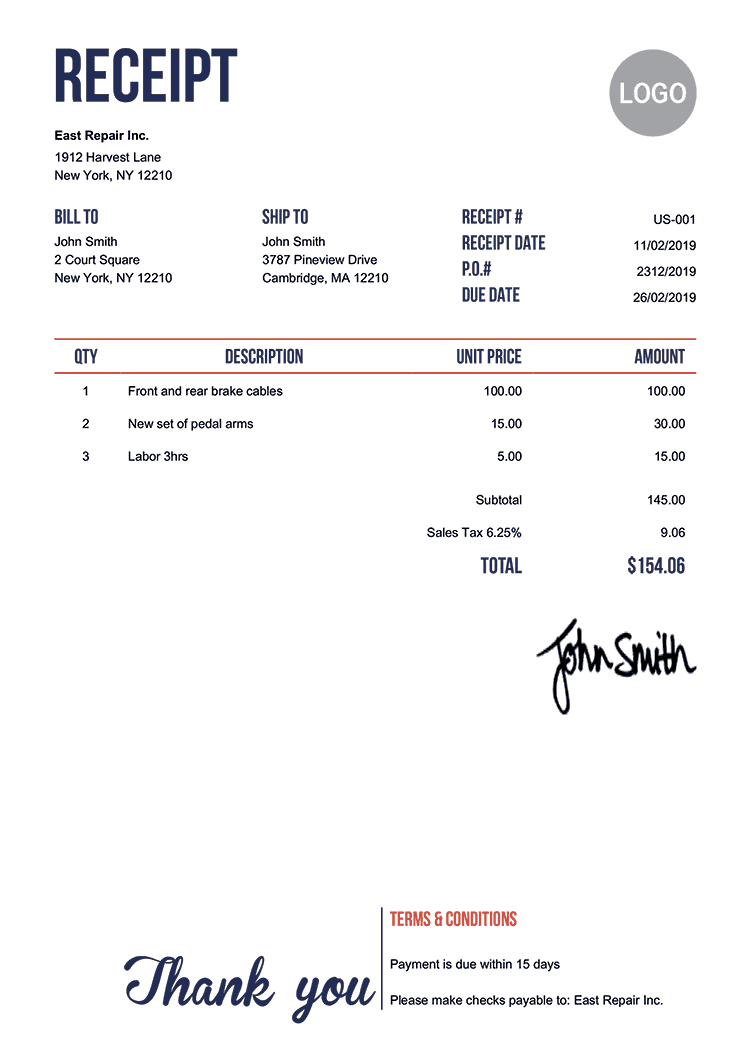

The original cost can be documented with copies of your purchase contract and closing statement. Improvements should be documented with purchase orders, receipts, cancelled checks, and any other documentation you receive.

Can I claim expenses without a receipt?

However, if you have no receipts, the IRS will not allow you to deduct the full amount of your expenses. The IRS will calculate the minimum standard amount for the service or item purchased by a taxpayer and will only allow a deduction for that amount.

What happens if you get audited and have no receipts?

Without specific receipts, the Cohan Rule says you can claim expenses if they are reasonable and credible, and you have attempted to show this to the IRS, using other documents as your audit defense tools.

Can you claim home improvements on your taxes?

When you make a home improvement, such as installing central air conditioning or replacing the roof, you can't deduct the cost in the year you spend the money. But, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house.

Should you keep track of home improvements?

How do I keep track of my home renovations?

Frequently Asked Questions

What happens if you don t have receipts for home improvements?

If the renovation or sale of your principal residence is the reason for the IRS audit, but receipts are unavailable, you can claim tax deductions. However, the IRS does not recognize repairing a leak, changing door locks, or fixing a window as a capital improvement.

How long do I have to buy another house to avoid capital gains?

Within 180 days

How Long Do I Have to Buy Another House to Avoid Capital Gains? You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

Is there a way to avoid capital gains tax on the selling of a house?

The 121 home sale exclusion, also known as the primary residence exclusion, is a tax benefit that allows homeowners to exclude a portion of the capital gains from the sale of their primary residence from their taxable income. This exclusion reduces the tax burden of selling a home.

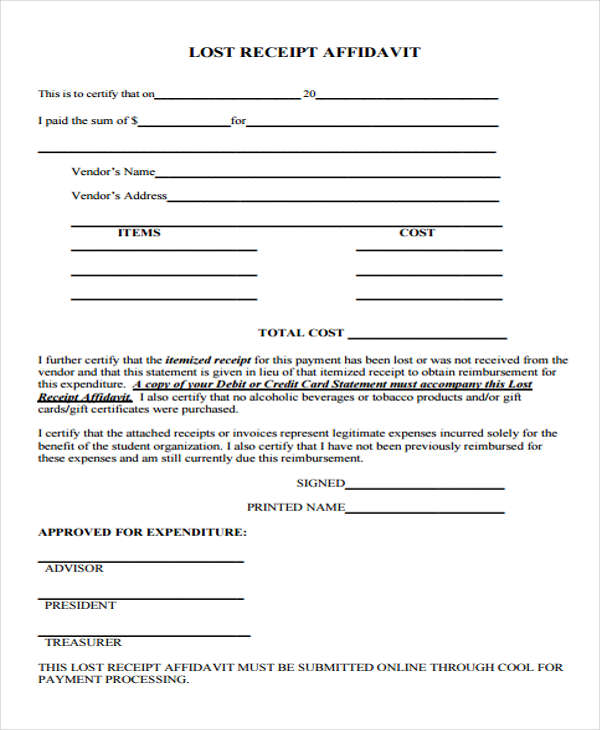

How do I get a copy of an old receipt?

How do you get a lost receipt reissued? For any lost receipts, the easiest way is to go to the original place of purchase. Most stores can look up your purchase and print you a new receipt if your method of payment was a credit or debit card.

Can Home Depot look up a receipt?

Approach the service desk and ask about getting a lost receipt. If you purchased within the last 30 days, the store will track the details of your transaction. The system will then search through untold numbers of credit cards and filter through them until they have found your card or cards.

FAQ

- Can Home Depot print out old receipts?

Can Home Depot pull up old receipts? Home Depot can pull up old receipts with your credit card, debit card or ProXtra number. They cannot however pull up cash transactions.

- How far back do stores keep receipts?

The general rule of thumb is to keep business receipts for as long as the IRS can audit your records. Usually, the IRS audits three years worth of records. Keep your business receipts for at least three years in case you need to show proof of purchases or sales.

- How do I keep track of home improvements?

- A Remodel Binder of Folder

A binder or folder offers an easy and appealing way to keep all the important documents for your remodel in one place. From the moment you start researching your remodel to when the contractors leave, there will be plenty of paperwork you will need to keep organized.

- Can I add home improvements to my cost basis?

A capital improvement that adds value to your home, prolongs its life, or adapts it to new uses can be added to the cost basis of your home and subtracted from the sales price to determine the amount of your profit when you sell it.

- What are examples of improvements that increase basis?

The cost of improvements, or money spent during the time you own a property to improve or add to its value, is added to basis. Some things that can increase basis include the cost of improvements anticipated to last for longer than a year (such as a new roof or HVAC system), impact fees and zoning costs.

What if i do not have receipt for home improvement

| Do I need receipts for home improvements for capital gains? | Proving Your Property's Tax Basis to the IRS Improvements should be documented with purchase orders, receipts, cancelled checks, and any other documentation you receive. |

| What does the IRS consider capital improvements on home? | A capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. The IRS grants special tax treatment to qualified capital improvements, distinguishing them from ordinary repairs. |

| What are the tax breaks for home improvements in 2023? | If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032. For improvements installed in 2022 or earlier: Use previous versions of Form 5695. |

| What qualifies as qualified improvement property? | Examples include the installation or replacement of drywall, interior doors, lighting, flooring, ceilings, fire protection, and plumbing. Any enlargement of the building, any elevator or escalator, and any internal structural framework do not meet the requirements of qualified improvement property. |

| Should I save home improvement receipts for taxes? | Make a special folder to save all your receipts and records for any improvements you make to your home. If you've lived in your house for many years, and area housing prices have been gradually going up over all those years, a portion of your gain on sale could be taxable. |

- What happens if you don t have receipts for capital improvements?

If the renovation or sale of your principal residence is the reason for the IRS audit, but receipts are unavailable, you can claim tax deductions. However, the IRS does not recognize repairing a leak, changing door locks, or fixing a window as a capital improvement.

- How far back can you write off home improvements?

Although you can't deduct home improvements, it's possible in some situations to depreciate them. "Depreciation" means that you deduct the cost over several years—anywhere from three to 27.5 years. To qualify to depreciate home improvement costs, you must use a portion of your home other than as a personal residence.

- What records should be kept for 7 years?

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

- Are new windows considered a capital improvement?

Repairs or maintenance cannot be included in a property's cost basis. However, repairs that are part of a larger project, such as replacing all of a home's windows, do qualify as capital improvements. Renovations that are necessary to keep a home in good condition are not included if they do not add value to the asset.